Personal Anecdote - 1

While I was on working I had all the time in the world to work and the leisure time was spent chatting and worrying about the future and not doing much about it.

I accumulated a good amount of money in my savings account. When I flaunted it in front of my CA friends, they made fun of me and explained to me the concept of inflation.

This sent me into a panic mode and I increased the voluntary contribution to Provident Fund by a whopping 46%.

Now that it has been more than 2 years to it, have read a total of 2 finance books and have no money to manage, I have realized what I did was terribly wrong but have also realized that I am not alone...

I accumulated a good amount of money in my savings account. When I flaunted it in front of my CA friends, they made fun of me and explained to me the concept of inflation.

This sent me into a panic mode and I increased the voluntary contribution to Provident Fund by a whopping 46%.

Now that it has been more than 2 years to it, have read a total of 2 finance books and have no money to manage, I have realized what I did was terribly wrong but have also realized that I am not alone...

Overview

According to “National Strategy for Financial Education: 2020-2025”, a report published by Reserve Bank of India on 17 March 2021 only 27% of Indians are financially literate.

This is also backed by on filed data that India has only 1.85 crore mutual fund investors (as of 21 December 2021). Closely looking at the data shows, that more than 65% lies in the income bracket less than 5 lakh/annum. But it gets depressing looking at the figures in above income levels.

There is still a silver lining, Millenials are rushing in to participate in Share Markets because of easy access of knowledge, opening up of new fronts of investments like cryptocurrency, NFTs, etc.

But, the lack of financial literacy coupled with a lot of new investors can become a new recipe of mayhem.

This is also backed by on filed data that India has only 1.85 crore mutual fund investors (as of 21 December 2021). Closely looking at the data shows, that more than 65% lies in the income bracket less than 5 lakh/annum. But it gets depressing looking at the figures in above income levels.

There is still a silver lining, Millenials are rushing in to participate in Share Markets because of easy access of knowledge, opening up of new fronts of investments like cryptocurrency, NFTs, etc.

But, the lack of financial literacy coupled with a lot of new investors can become a new recipe of mayhem.

Research Focus and Path Followed

There are two goals for conducting research, primary being able to identify what makes people averse to financial literacy and financial planning and secondary for me to understand the domain of financial literacy so that when I start earning again I don’t struggle to manage my money and make it work for me.

Online Research

Defining Financial Education and Financial Literacy

Financial Education, is defined as the process by which financial consumers/investors improve their understanding of financial products, concepts, and risks and through information, instruction, and/or objective advice, develop the skills and confidence to become more aware of financial risks and opportunities, to make informed choices, to know where to go for help and to take other effective actions to improve their financial well-being”.

Financial Literacy is defined as a combination of financial awareness, knowledge, skills, attitude, and behavior necessary to make sound financial decisions and ultimately achieve individual financial well-being.

Financial Literacy is defined as a combination of financial awareness, knowledge, skills, attitude, and behavior necessary to make sound financial decisions and ultimately achieve individual financial well-being.

Findings of First National Strategy for Financial Education (2013 - 18)

NSFE 1 achieved a good deal with coordinated efforts of all the stakeholders but there is still a long way to go and we are already in the middle of NSFE 2.

The Strategic Objectives of NSFE (Source: NSFE 2020-2025)

With the vision of A financially aware and empowered India following are the 9 strategic objectives of NSFE:

• Inculcate financial literacy concepts among the various sections of the population through financial education to make it an important life skill

• Encourage active savings behavior

• Encourage participation in financial markets to meet financial goals and objectives

• Develop credit discipline and encourage availing credit from formal financial institutions as per requirement

• Improve usage of digital financial services in a safe and secure manner

• Manage risk at various life stages through the relevant and suitable insurance cover

• Plan for old age and retirement through coverage of suitable pension products

• Knowledge about rights, duties, and avenues for grievance redressal

• Improve research and evaluation methods to assess progress in financial education

• Inculcate financial literacy concepts among the various sections of the population through financial education to make it an important life skill

• Encourage active savings behavior

• Encourage participation in financial markets to meet financial goals and objectives

• Develop credit discipline and encourage availing credit from formal financial institutions as per requirement

• Improve usage of digital financial services in a safe and secure manner

• Manage risk at various life stages through the relevant and suitable insurance cover

• Plan for old age and retirement through coverage of suitable pension products

• Knowledge about rights, duties, and avenues for grievance redressal

• Improve research and evaluation methods to assess progress in financial education

User Interviews

Unstructured interviews were conducted via zoom and at large following themes were discussed:

• Annual Income

• How do they keep a track of their spendings

• Monthly expenses

• How do they transact, cash/card/UPI

• How much are they able to save and their plans of sending it

• Investments

• Frustrations of managing money

• Loans

• Insurances

• Emergency Funds

• Their understanding of financial well being

• Annual Income

• How do they keep a track of their spendings

• Monthly expenses

• How do they transact, cash/card/UPI

• How much are they able to save and their plans of sending it

• Investments

• Frustrations of managing money

• Loans

• Insurances

• Emergency Funds

• Their understanding of financial well being

Important Findings

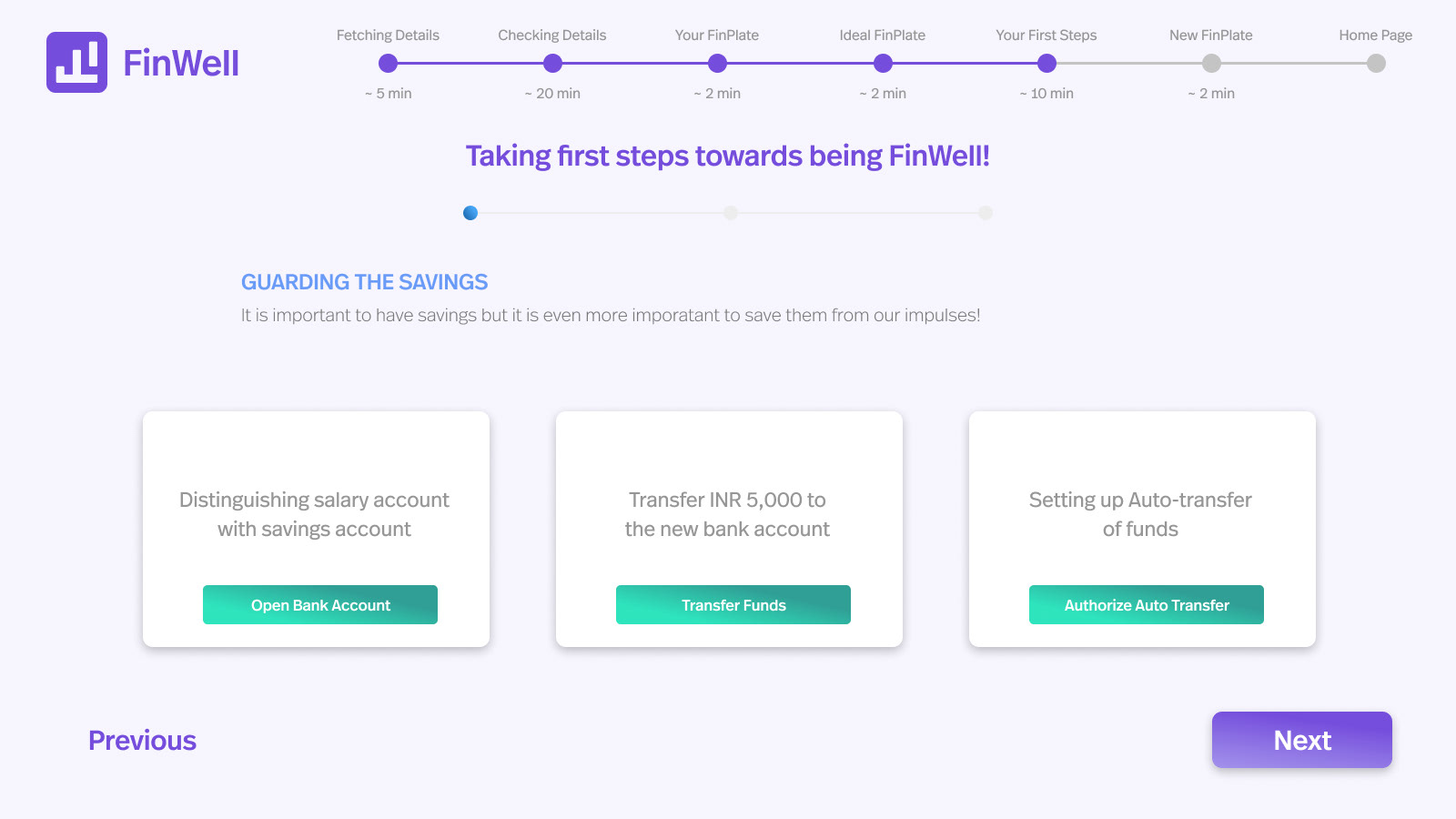

• The interview findings were exactly in line with that of the NSFE survey. Lack of knowledge of investments, no savings, no concept of an emergency fund.

• The emergency fund was mixed with saving for buying new gadgets, vacations, etc.

• Some participants had two accounts to guard their savings.

• All the participants were spending 80% through UPI/Digital wallet payments.

• All participants had at least two digital wallets installed in their phones which they used regularly.

• The emergency fund was mixed with saving for buying new gadgets, vacations, etc.

• Some participants had two accounts to guard their savings.

• All the participants were spending 80% through UPI/Digital wallet payments.

• All participants had at least two digital wallets installed in their phones which they used regularly.

Personal Anecdote - 2

One fine day in lockdown my younger brother was sitting in front of his laptop and looked stressed. On asking, I got to know that he was reconciling our family’s monthly expenses and couldn’t remember where was a particular transaction done.

Even when he entered in comments, the reports of a well-known wallet app that recently launched an IPO casually deleted the user comments.

Talking to him further I got to know that he has deleted all the wallets because it was too cumbersome to remember everything. Mind you, all the wallets were joined to avail the initial cashback benefits.

He somehow figured out that payment and I got back to doing something more important only to return to the same thing a semester later...

And here as well, my brother is not the only one.

Even when he entered in comments, the reports of a well-known wallet app that recently launched an IPO casually deleted the user comments.

Talking to him further I got to know that he has deleted all the wallets because it was too cumbersome to remember everything. Mind you, all the wallets were joined to avail the initial cashback benefits.

He somehow figured out that payment and I got back to doing something more important only to return to the same thing a semester later...

And here as well, my brother is not the only one.

Persona Creation

Based on the Primary and Secondary research following personas were created:

Design Brief

Design a solution to provide us with an overview of our money and make us financially literate while ensuring our financial well-being.

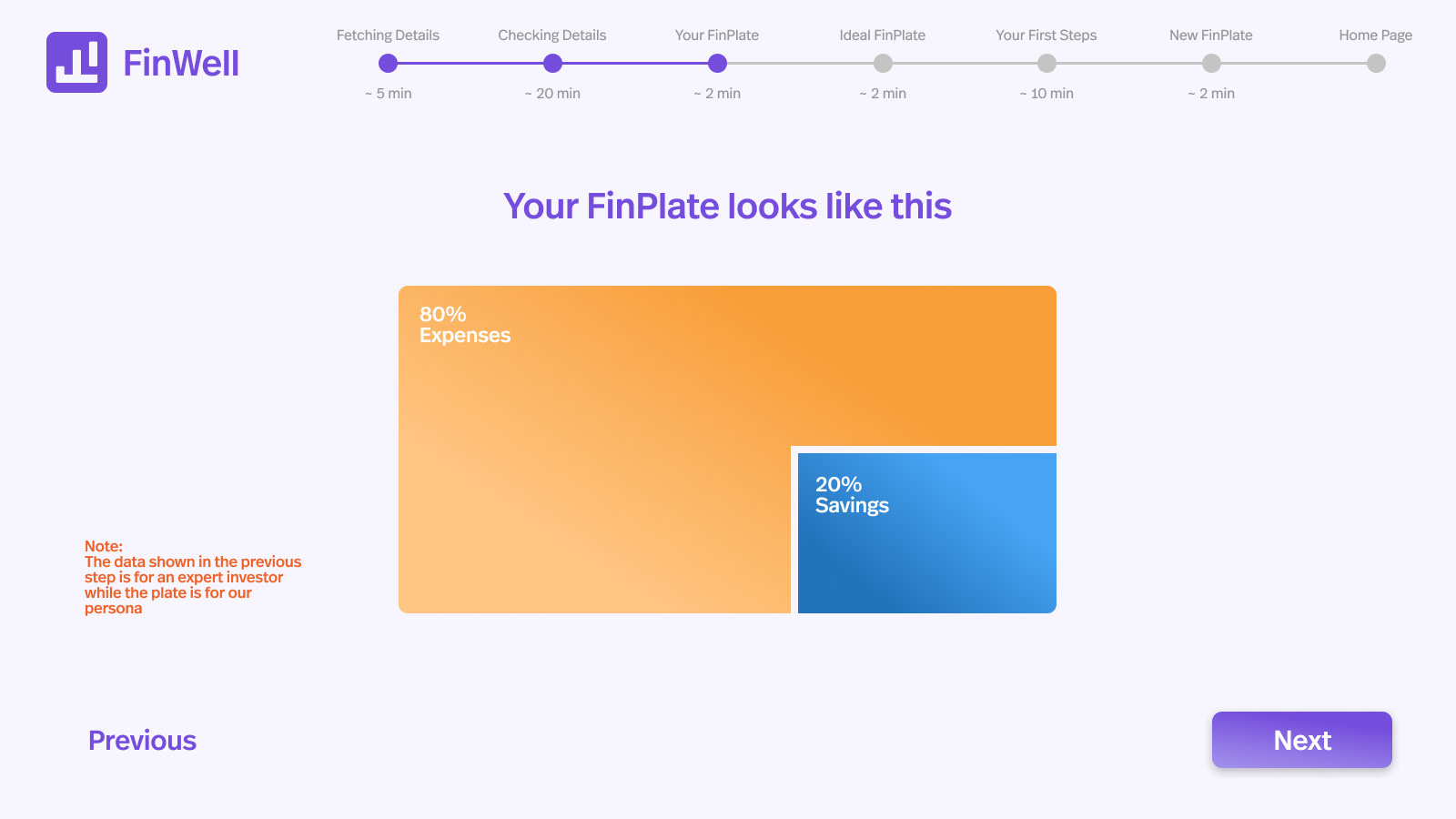

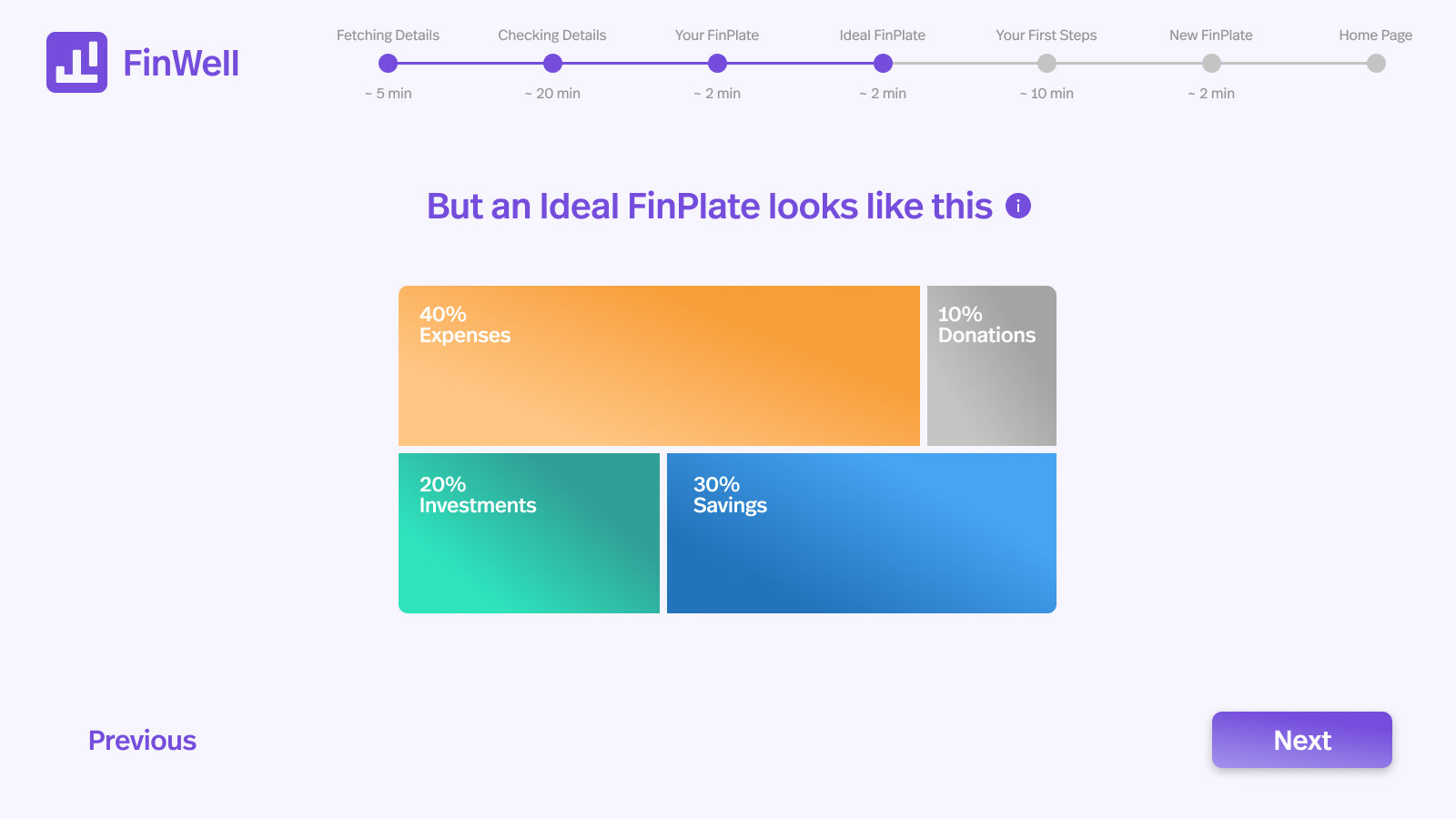

The metaphor of a Balanced Diet

Thalis/Plates are designed to provide you with a balanced diet. In a similar way, we also need a financial thali that takes care of our financial diet.

The solution uses this metaphor and the diagram is called ‘FinPlate’.

The solution uses this metaphor and the diagram is called ‘FinPlate’.

Information Architecture

Identity Design

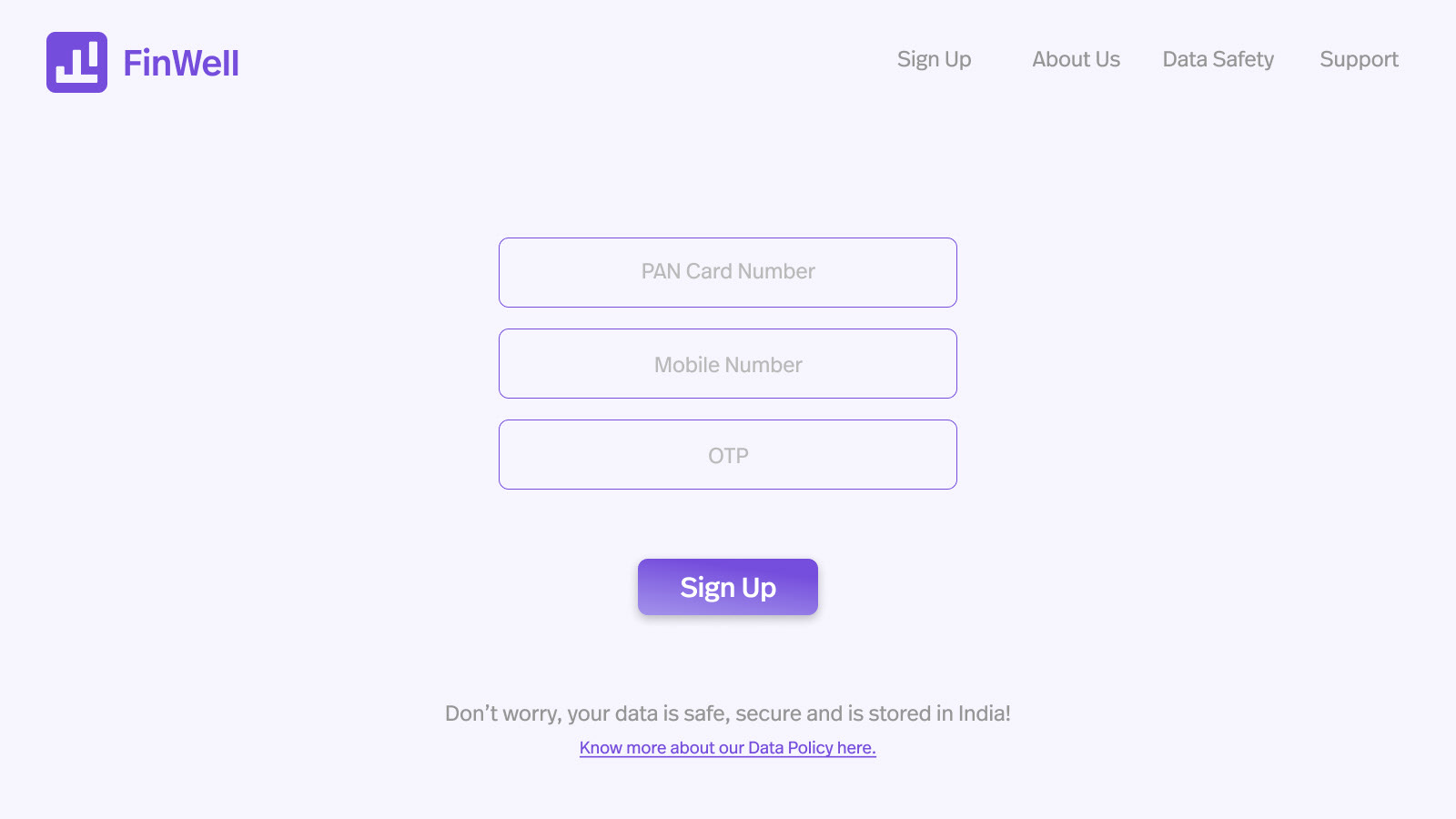

High Fidelity Screens

Login Screens

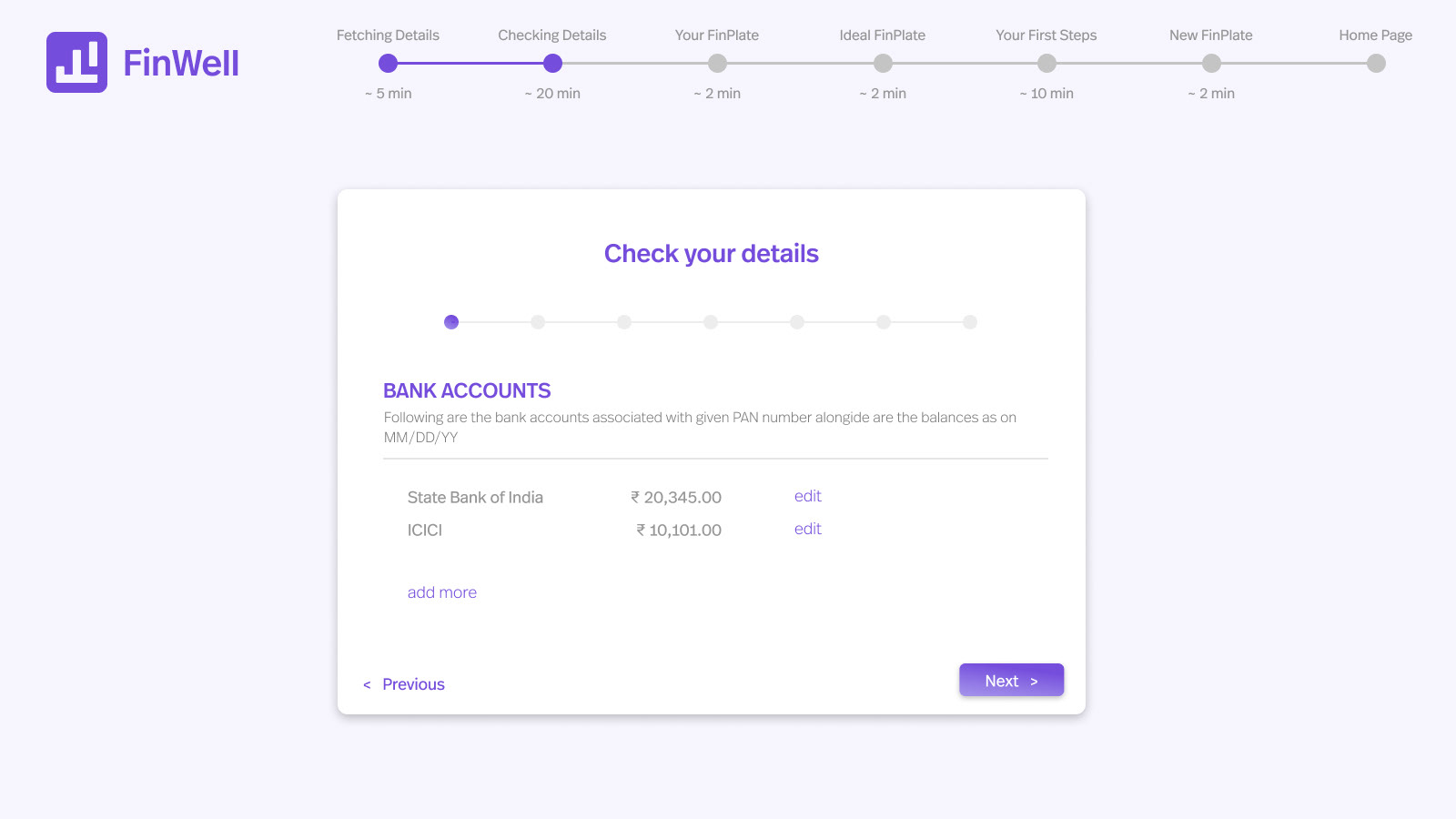

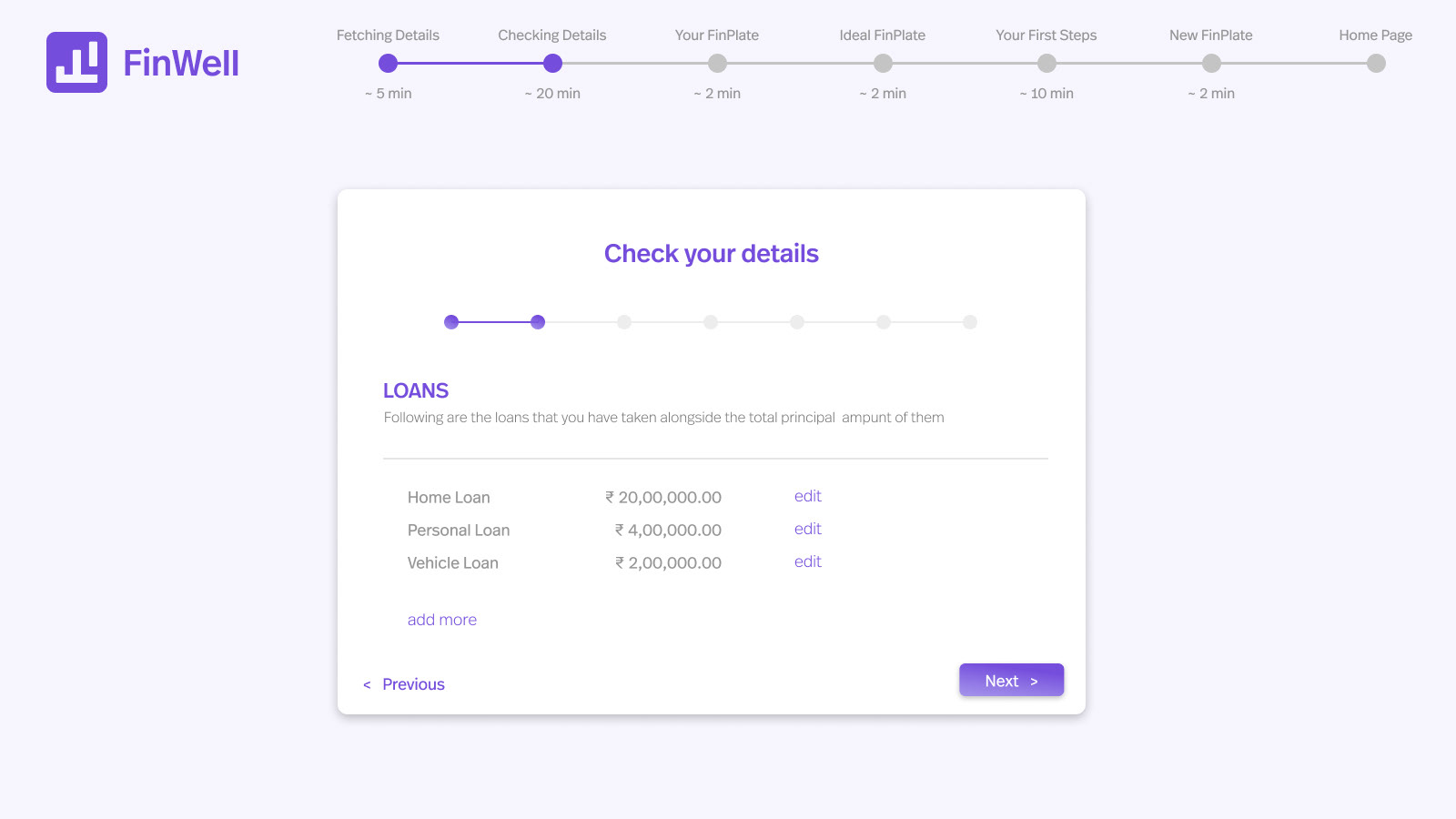

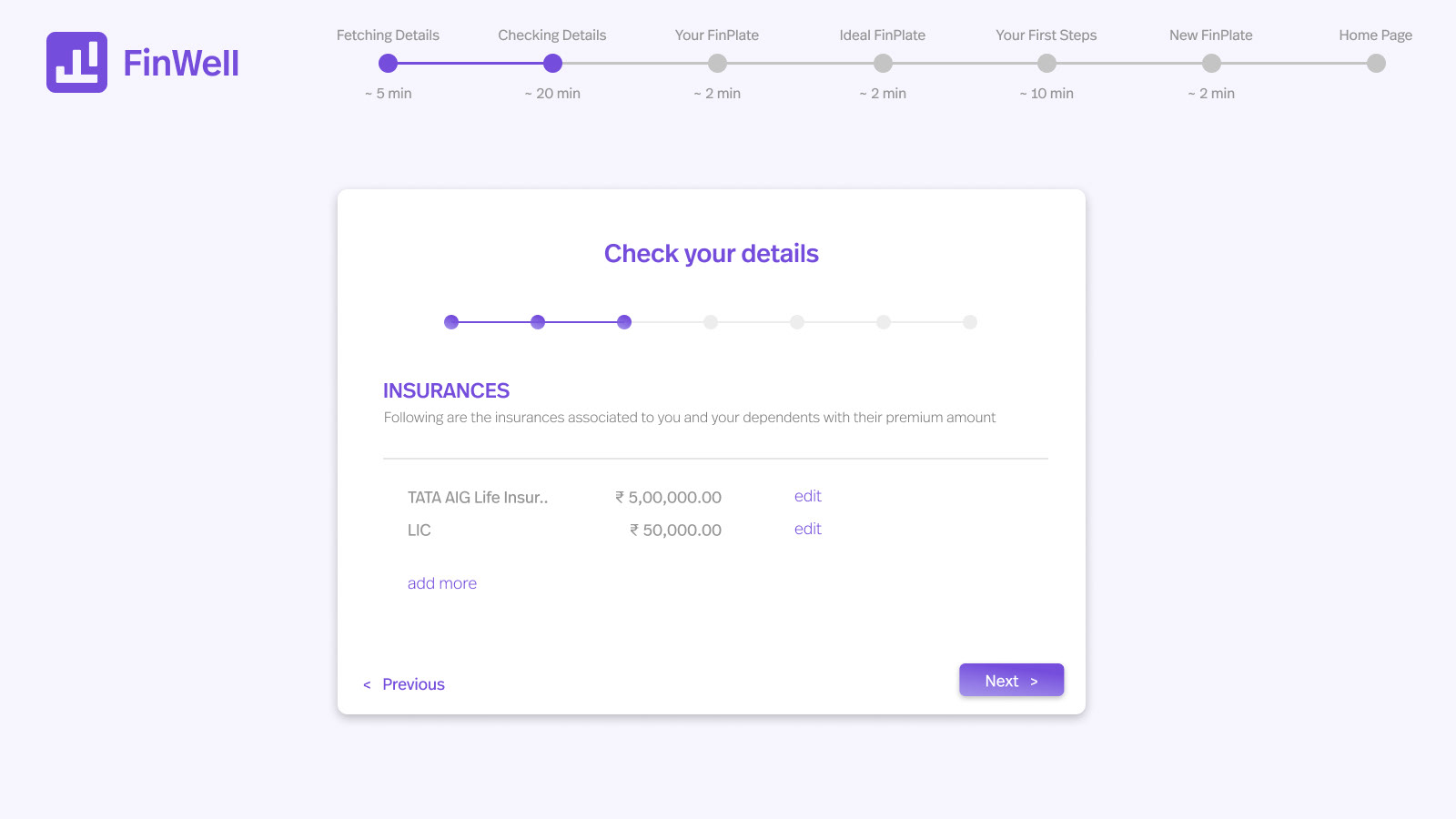

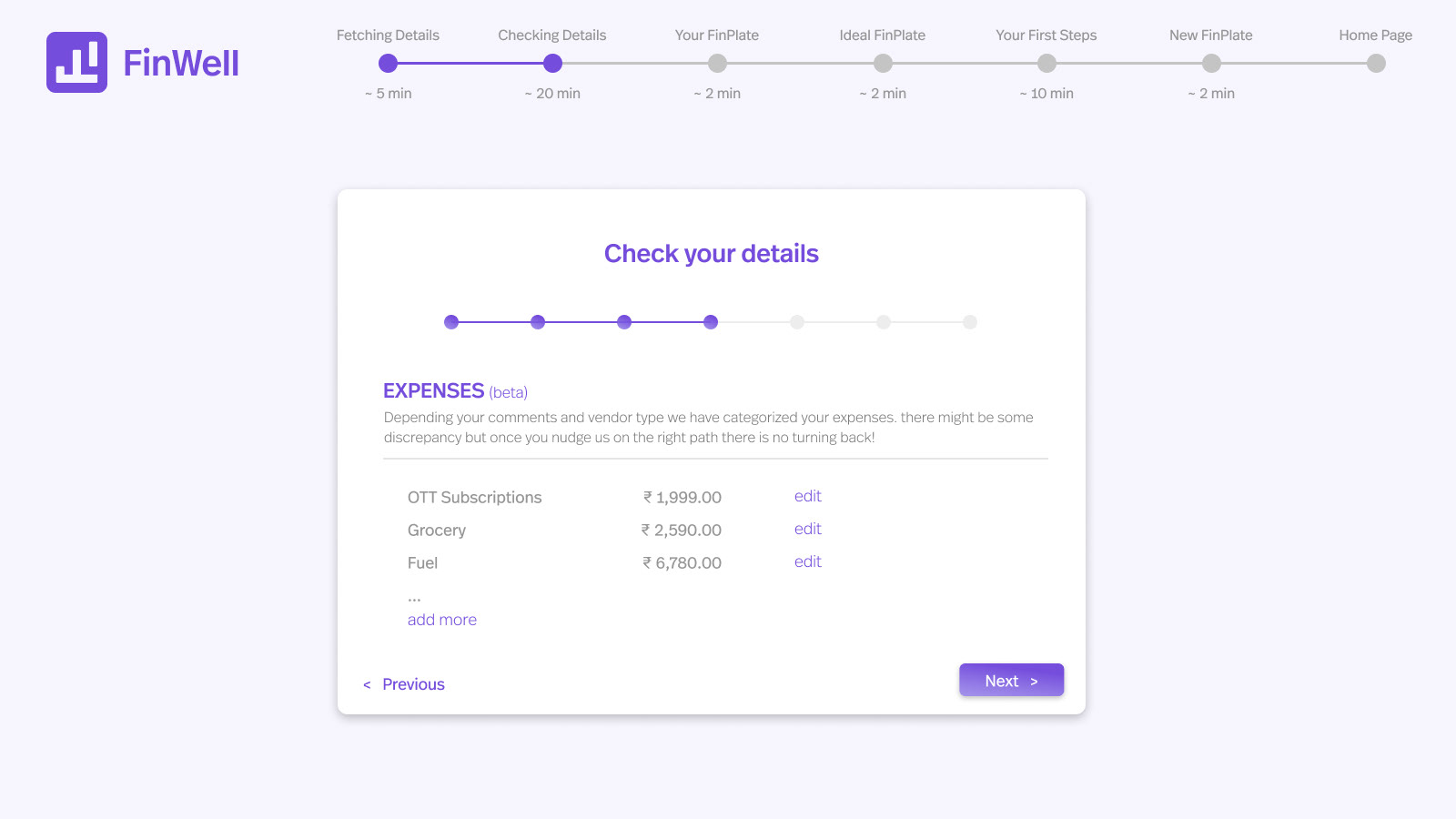

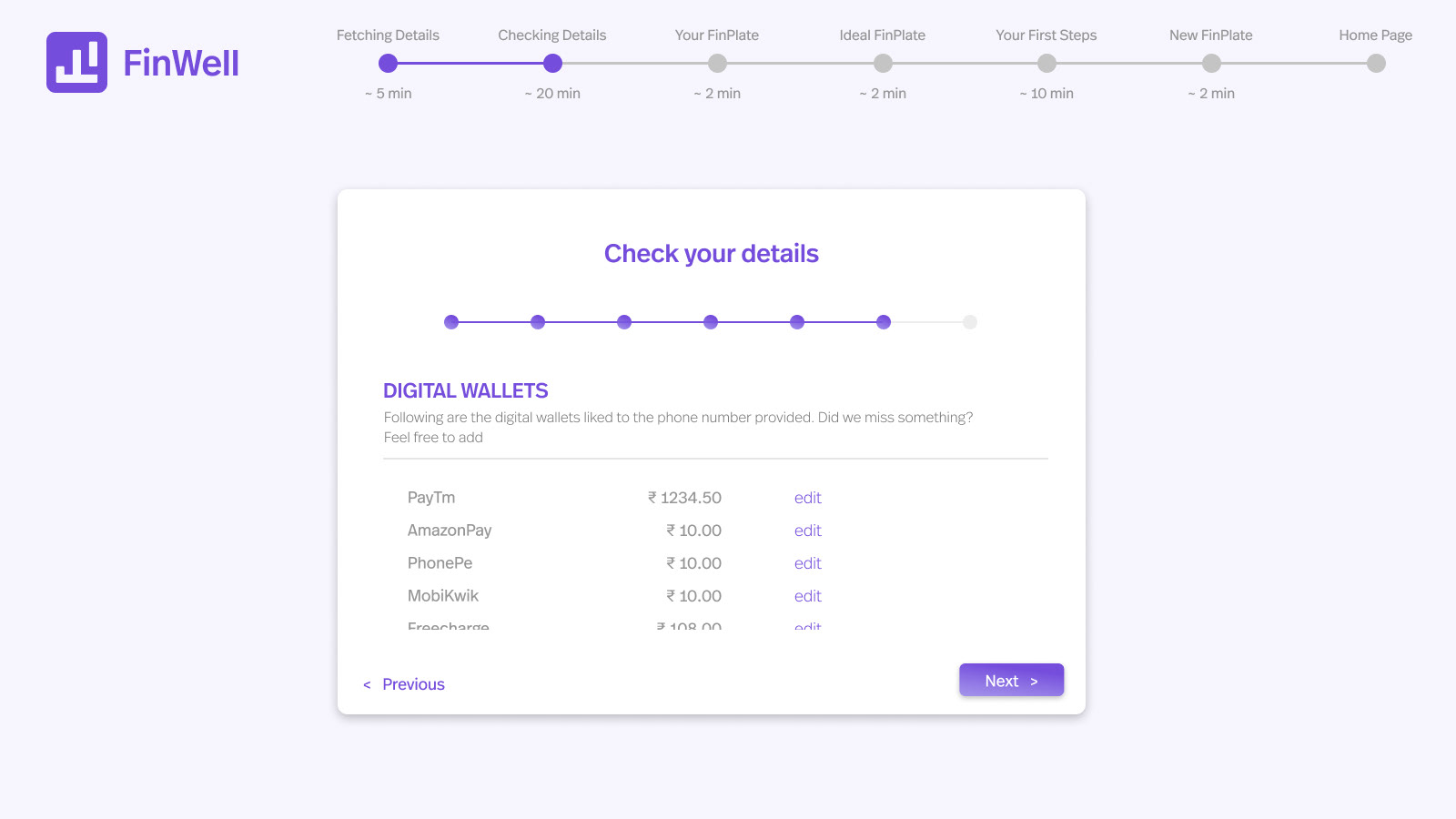

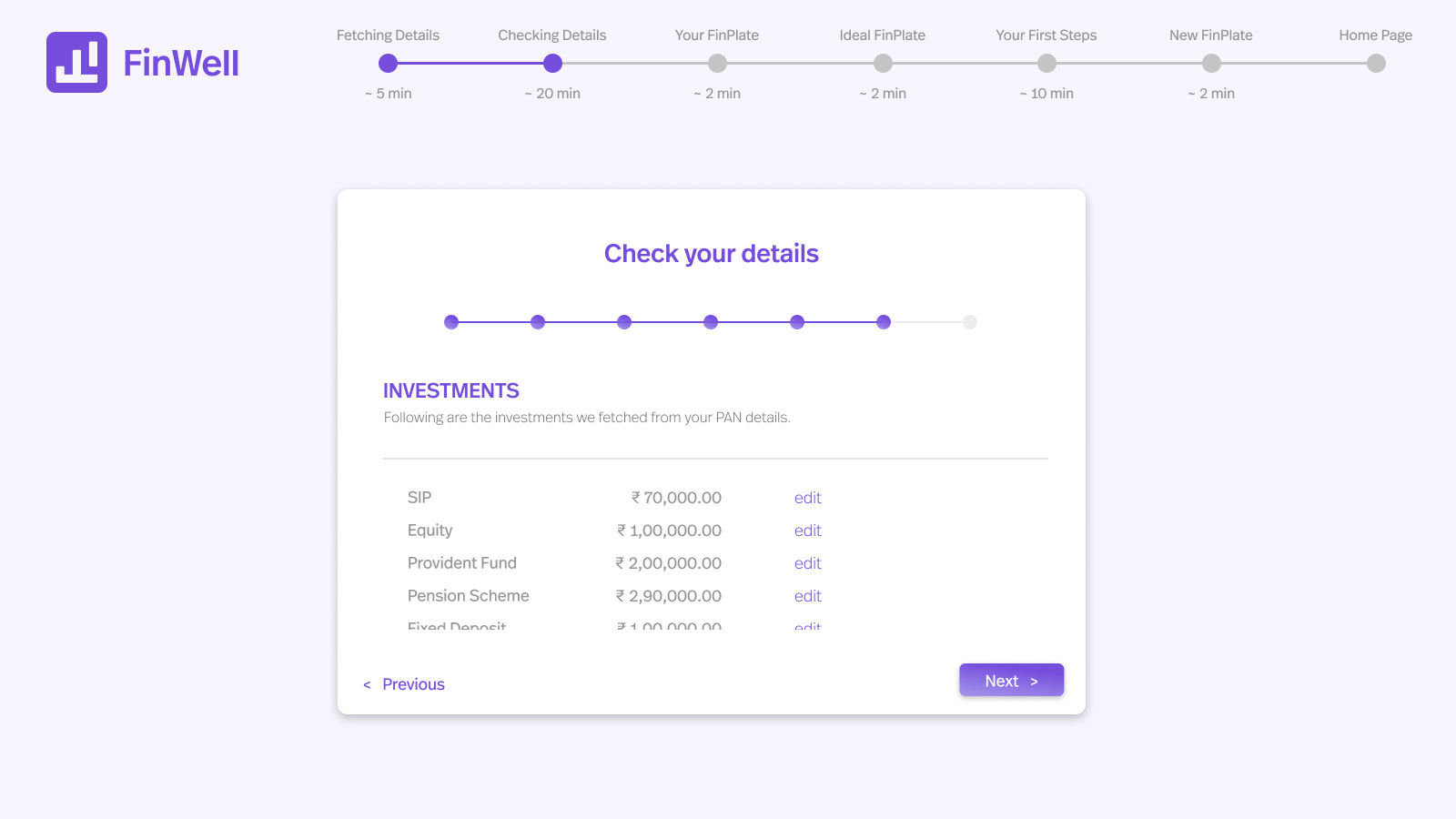

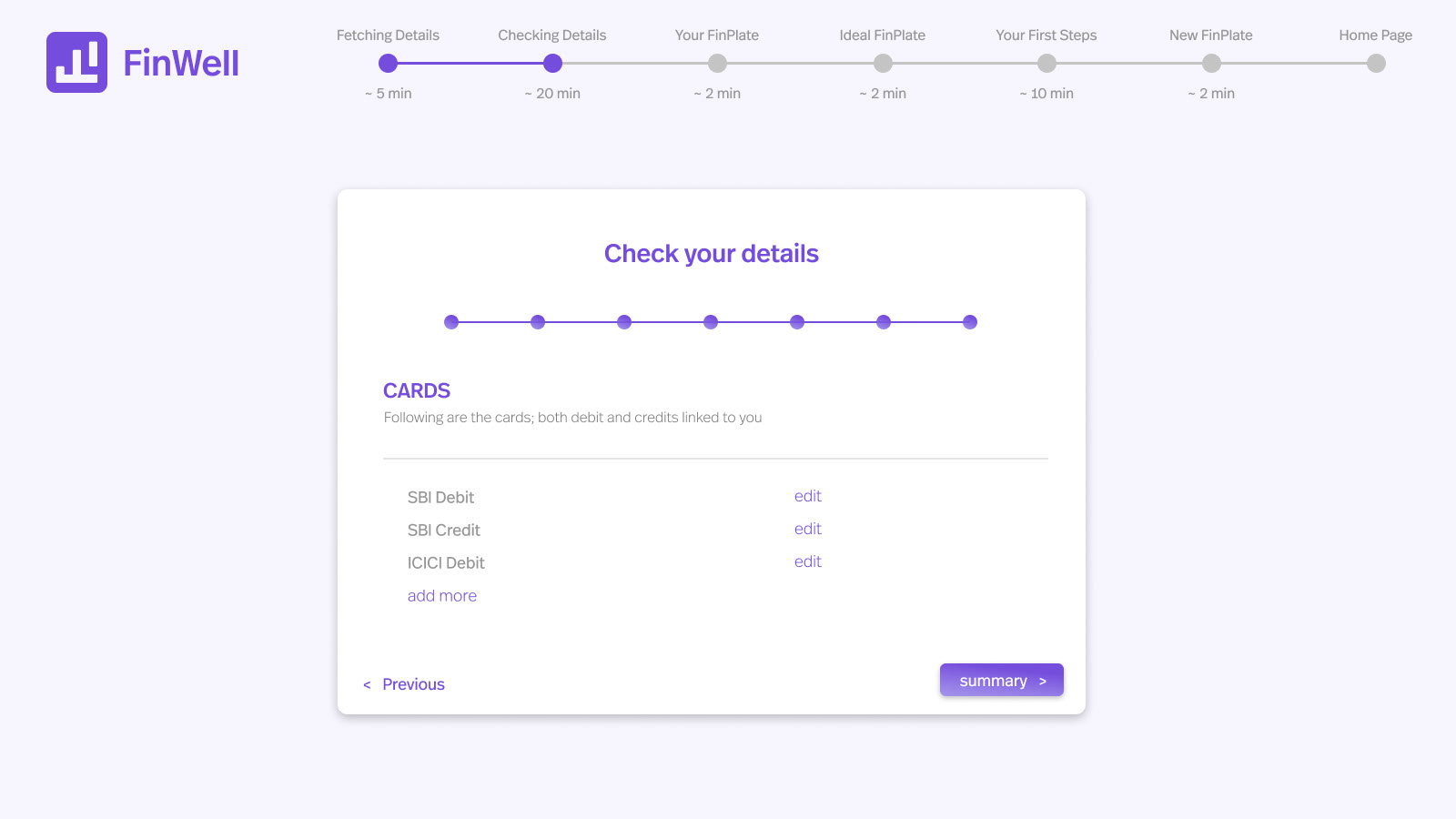

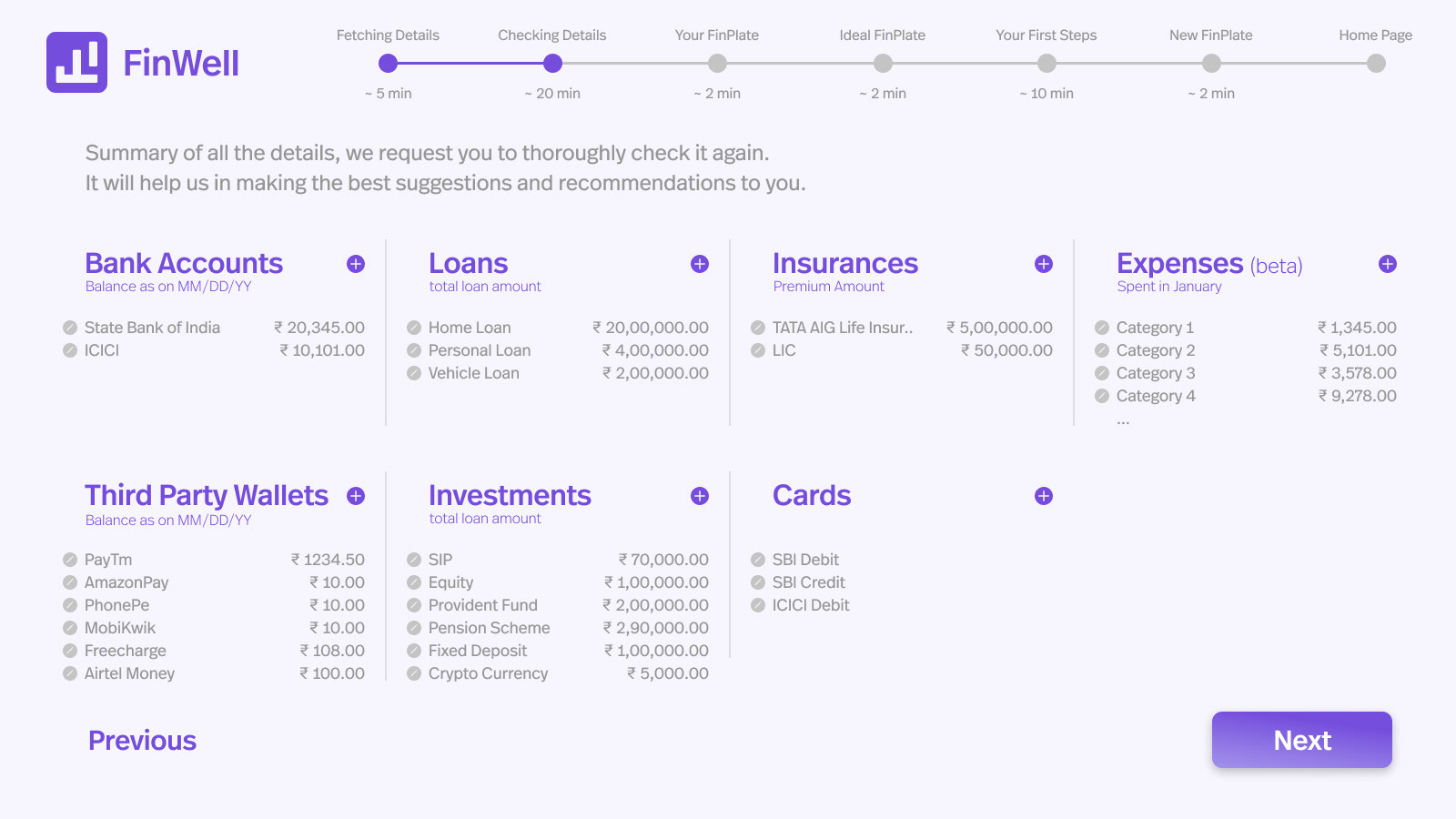

Details Page

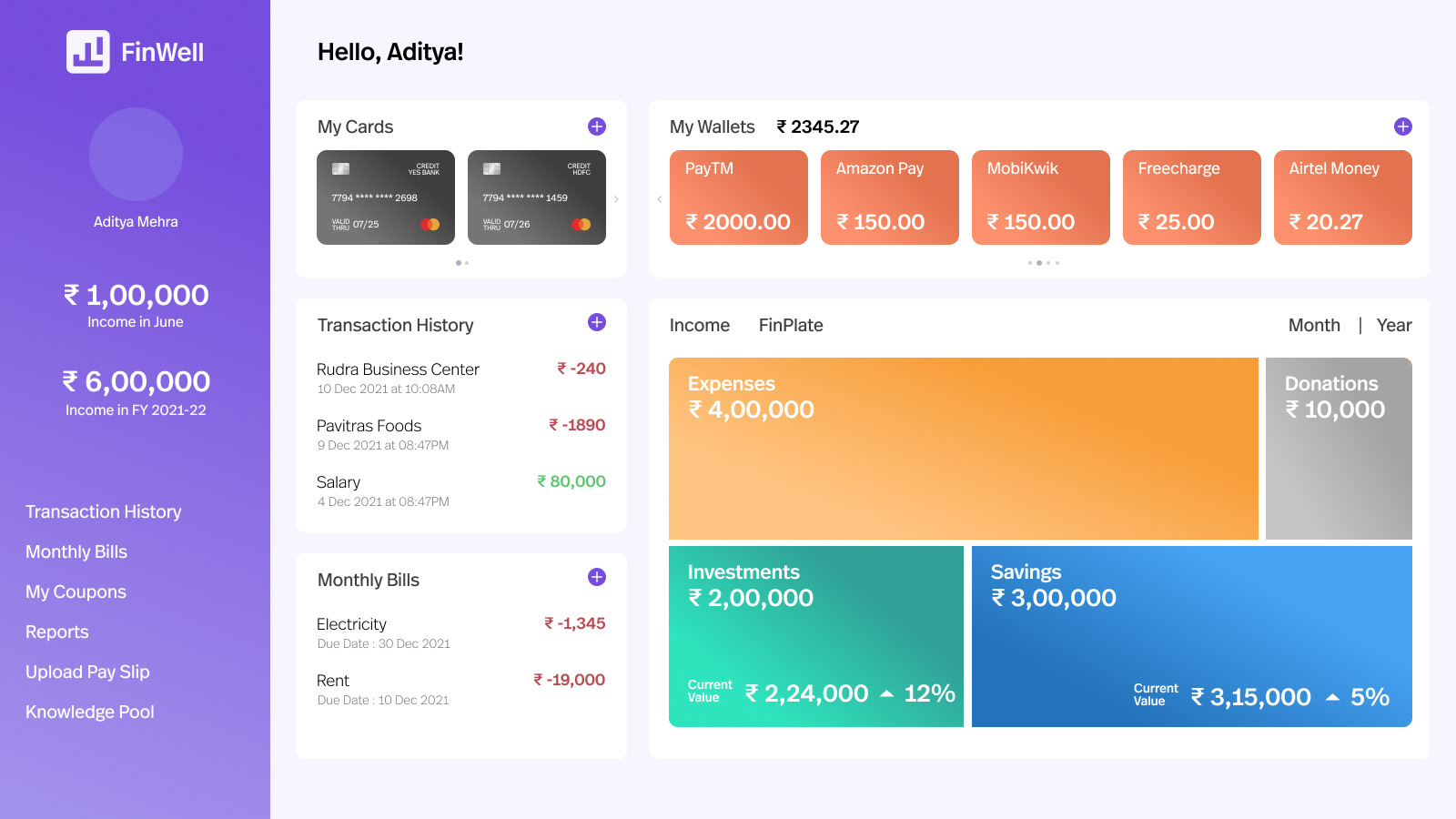

Comparison FinPlate

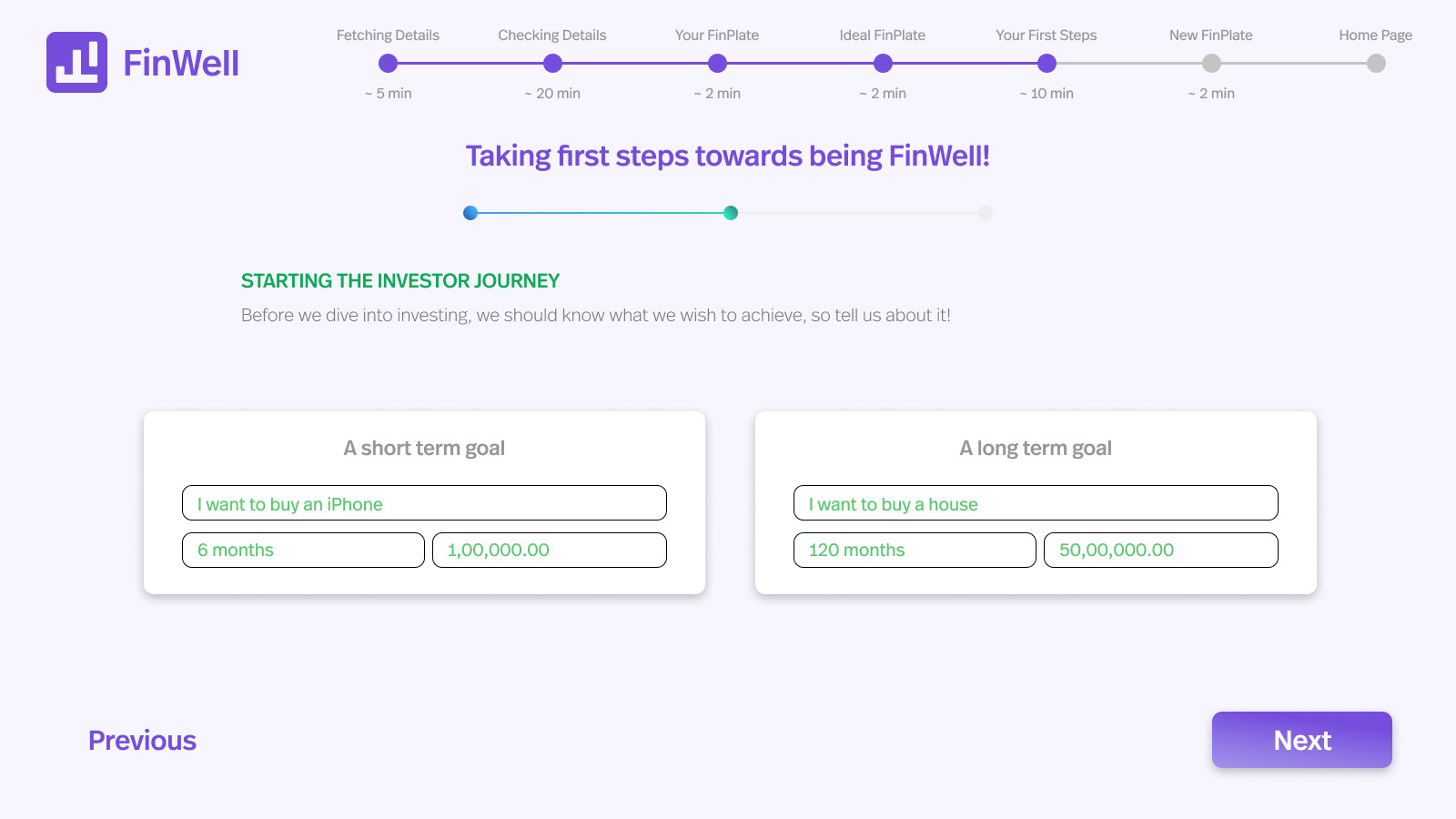

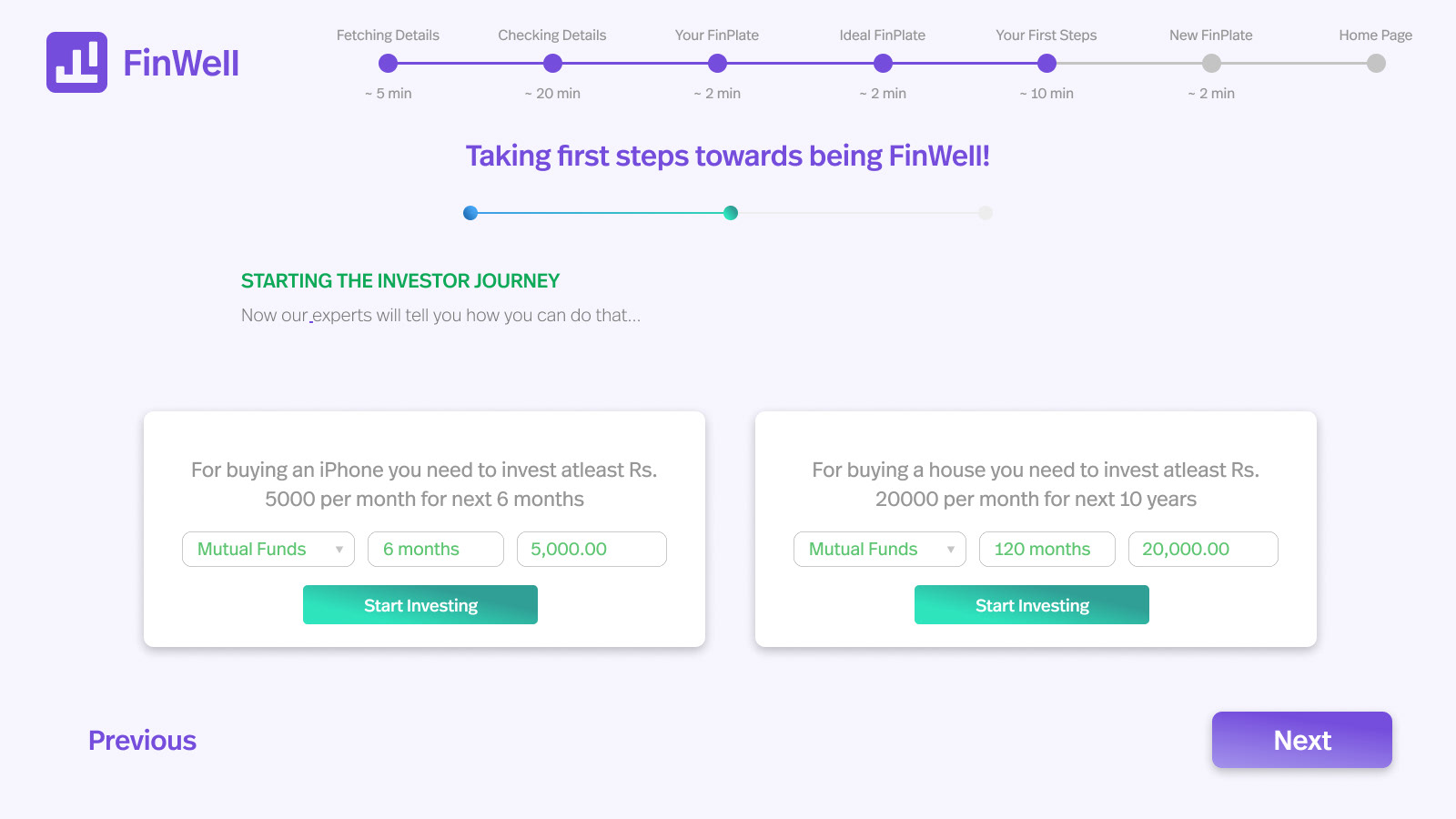

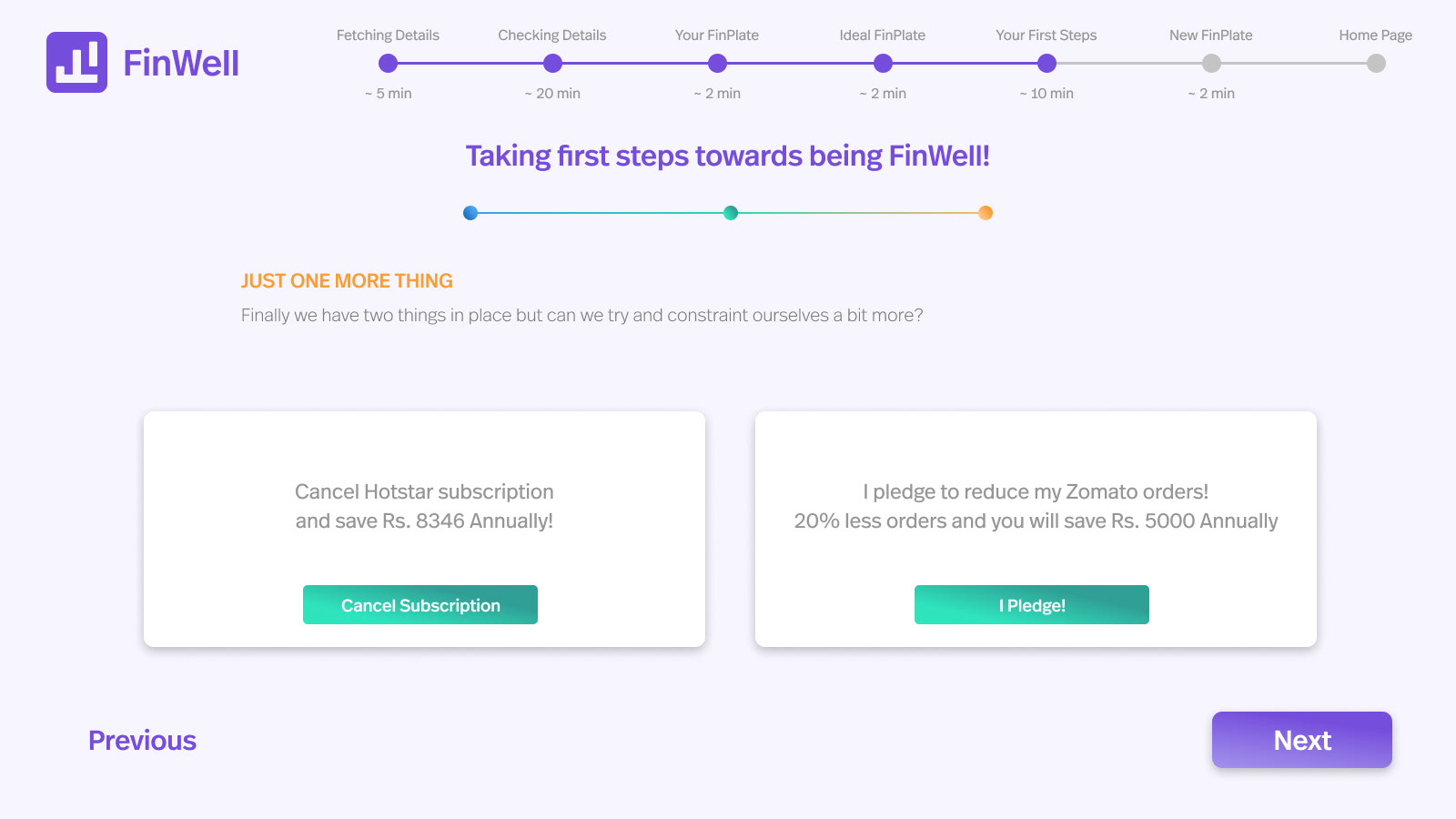

Taking First Steps

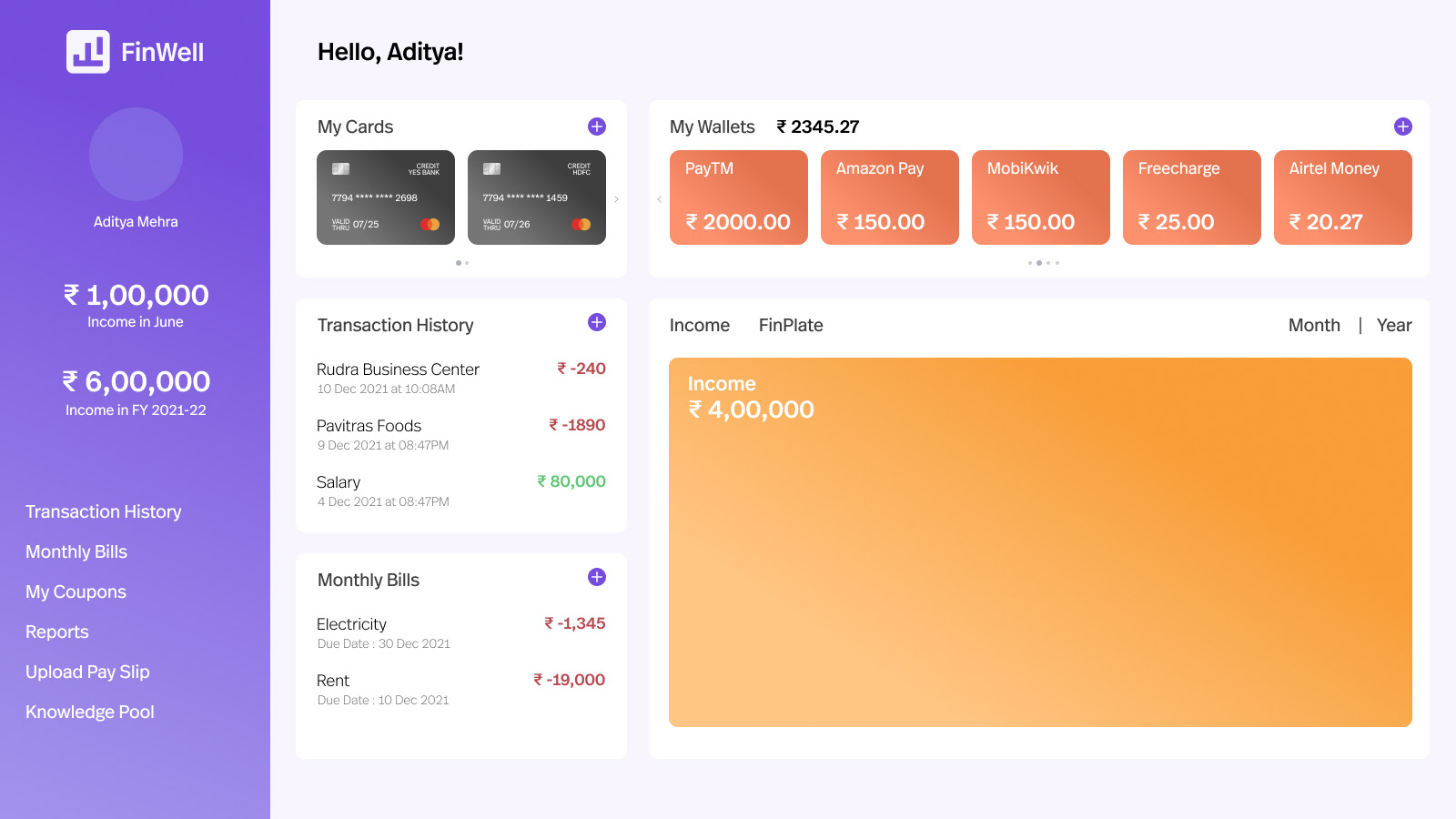

Home Page

Video Walkthrough